Under the Federal Tax Authority (FTA), strict registration, compliant obligation and filing have become necessary for businesses to follow 9% Federal corporate tax law.

Most of the organizations depend on UAE corporate tax compliance PRO in order to manage documentation registration deadlines and audits that can assure penalty avoidance, accuracy and complete maintenance of regulatory compliance whereas business owners focus on operations.

UAE corporate tax compliance PRO for 9% tax basics

It is necessary to learn UAE corporate tax compliance PRO under 9% tax basics. Here is quick breakdown you need to follow:

- 9% UAE corporate tax is applied on a profit exceeding AED 375,000.

- Qualifying foreign companies, free zone entities and mainland companies must get applicability.

- Qualifying freezone persons require 0% on eligible income, subject to conditions.

- Corporate tax is applicable on financial years studying on and from 1st June 2023.

- UAE corporate tax compliance PRO assure exemptions, classifications and applicability.

Also read about the company liquidation process.

FTA registration for UAE corporate tax compliance PRO

FTA registration under UAE corporate tax compliance PRO is also a considerable factor needed to be learned.

- Corporate tax registration is necessary through the FTA EmaraTax portal.

- Each business must collect a Corporate Tax Registration Number (CTRN).

- Necessary documents comprise MOA, financial year details and passport copies.

- Registration deadline depends on entity type and license issue date.

- Late or error in registration may cause administrative penalties.

- UAE corporate tax compliance PRO control end-to-end FTA registration punctually.

Transfer pricing rules based on UAE corporate tax compliance PRO

There are also pricing rules to understand UAE corporate tax compliance PRO charges. Here is a quick breakdown:

| Aspect | Requirement | PRO Support role |

| Related party transactions | Must follow arm’s length principle. | Identify related parties. |

| Documentation | Local and master file. | Prepare and maintain records. |

| Disclosure | Mandatory transfer pricing disclosure. | Accuracy in FTA submission. |

| Penalty risk | High misreporting | Compliance risk mitigation. |

Readers also search for the Dubai trade license renewal process.

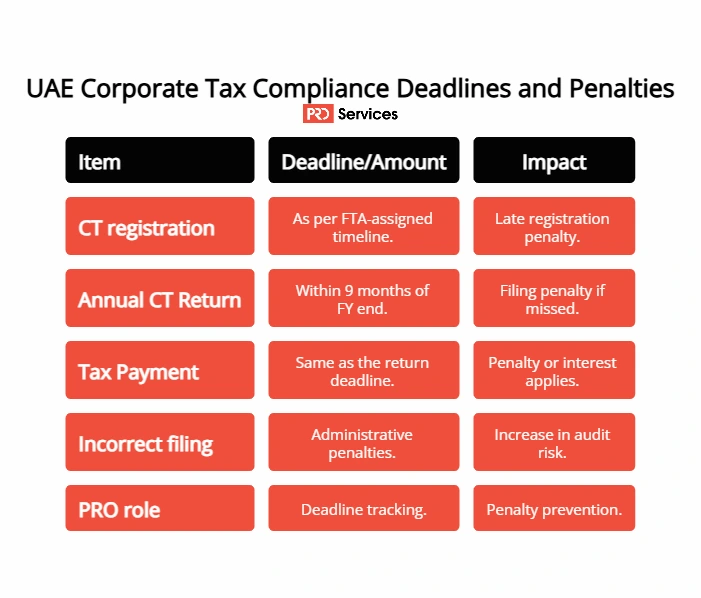

UAE corporate tax compliance PRO deadlines and penalties

Not following UAE corporate tax compliance can lead to failure of deadlines subjected to penalties. Here is a quick breakdown:

| Item | Deadline/Amount | Impact |

| CT registration | As per FTA-assigned timeline. | Late registration penalty. |

| Annual CT Return | Within 9 months of FY end. | Filing penalty if missed. |

| Tax Payment | Same as the return deadline. | Penalty or interest applies. |

| Incorrect filing | Administrative penalties. | Increase in audit risk. |

| PRO role | Deadline tracking. | Penalty prevention. |

UAE corporate tax compliance PRO role in filings and audits

PRO role in filings and audits can help in marking UAE corporate tax compliance on time. Here is a quick breakdown –

- Prepare and file one annual corporate tax return accurately.

- Accountant coordination for taxable profit calculation.

- Ensure supporting documents to be compliant and also transfer pricing disclosures.

- Perform as one liaison between FTA and the business.

- Manage and maintain compliance calendars for preventing missed deadlines and penalties.

Conclusion

UAE corporate tax compliance is a mandatory and legal factor. From FTA registration to audits, transfer pricing and filing, a UAE corporate tax compliance PRO can assure business compliance, audit-ready and penalty-free.

Now it’s your time to engage with us to experience a professional PRO service to achieve corporate tax compliance and avoid costly mistakes.

Frequently Asked Questions (FAQs)

Who must register for UAE corporate tax?

All the qualifying foreign entities, free zone and mainland are taxable.

What is the rate of UAE corporate tax?

UAE corporate tax rate is 9% on taxable profits exceeding AED 375,000.

Is corporate tax registration necessary even with zero tax payable in the UAE?

Yes, corporate tax registration is mandatory even with zero tax payable in the UAE.

Is free zone companies exempt from corporate tax?

Only if they qualify as qualifying free zone persons.

Can a PRO handle FTA audits?

Yes, PRO’s can coordinate audit responses and submission.

No comment yet, add your voice below!