Company liquidation in Dubai comprises business closing in legal format, settling outstanding debts, trade license deregistration, visa cancellation and authority notification.

This process usually requires 30 to 90 days depending on variable costs that totally align with visas, company type, government fees and outstanding liabilities. Let’s explore this blog to take a proper execution avoiding fines, legal issues and immigration complications.

DED/free zone differences in terms of Company liquidation in Dubai

Difference of the free zone and DED in terms of Company liquidation Dubai is as follows —

| Aspect | DED (Mainland) | Free Zone |

| Authority | Department of Economic Development (DED) | Free zone Authority |

| Liquidator | Necessary for LLC. | Partially required. |

| Notice period | 45 days Publication. | free zone variable. |

| Timeline | 60 to 90 days. | 30 to 60 days. |

| Visa cancellations | Via GDRFA or MOHRE. | GDRFA + free zone. |

| Cost range | AED 8,000 to 25,000. | AED 6,000 to 15,000+ |

| Newspaper req. | Yes | Sometimes |

| Audit required | Often | Depends on zone type. |

| Clearance certificate | MOHRE, FTA Bank and lease. | Free zone-specific NOCs. |

| Article of Association | Needed | Variable |

Also read about MOA features and POA and notarization.

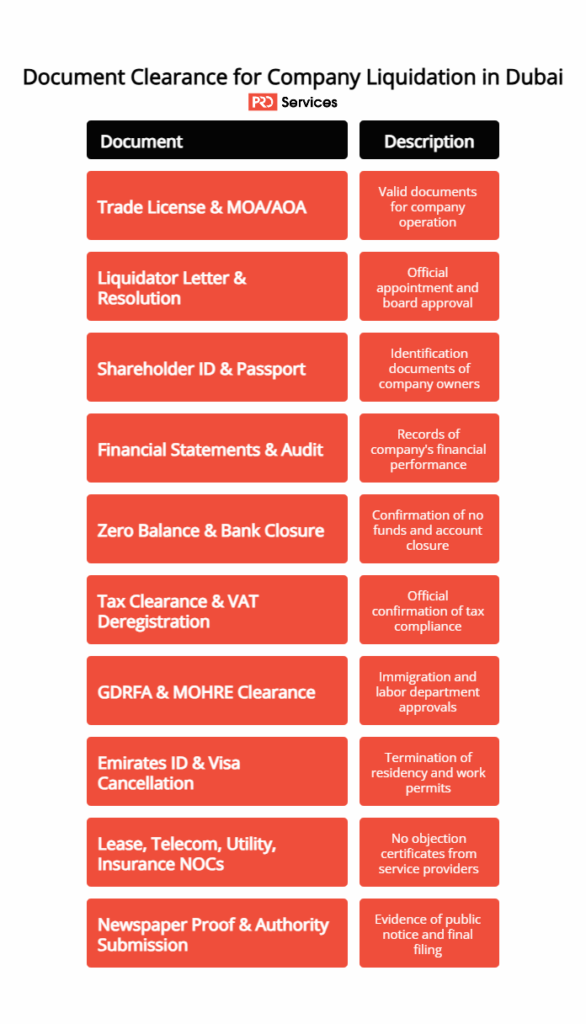

Document clearance for Company liquidation in Dubai

Company liquidation Dubai depends on particular document clearance. Here is a quick breakdown for you to learn about the document clearance.

- Valid trade license and MOA/AOA.

- Liquidator appointment letter and board resolution.

- Shareholder Emirates ID and passport.

- Financial statements and final audit report.

- Zero balance confirmation and Bank closure letter.

- Tax clearance and VAT deregistration (FTA).

- GDRFA and MOHRE immigration and labour clearance.

- Emirates ID and Visa cancellation.

- Lease, Telecom, utility and insurance NOCs.

- Newspaper publication proof and final authority submission.

Visa cancellations in case of Company liquidation in Dubai

Cancellation of visa is necessary before getting final licence cancellation. Here is how you need to do it —

- Cancellations

- Employee visas with GDRFA.

- Investor or partner visas.

- Labour cards through MOHRE.

- Dependent or family visa linked to the company.

- Final pay settlement benefits for employees.

- Recovery of unused visa balance deposits.

- Collection of final stamped visa cancellation letters.

- Submission of cancellation proves to the authority.

- Ensuring no active visas to avoid the delay.

- Liquidator coordination for queue scheduling.

- Using authority portals for visa status checks.

- Pay outstanding fines for late cancellations.

- Keep copies of the MOHRE/GDRFA confirmations.

Also acknowledge details about your trade license Dubai.

Debt settlement for Company liquidation in Dubai

You also should take care of the debt settlement for company liquidation Dubai. Here is a quick note for you to beware about —

- Gratuity, outstanding salaries and notice period payments.

- Facility management dues, lease termination and rent.

- Internet, Telecom, utility and software subscriptions.

- Credit lines, bank loans, interest and guarantees.

- Corporate tax, VAT, custom duties and penalties.

- Liquidator, audit, legal and consultancy fees.

- Deposit forfeits and Visa cancellation charges.

- Warranty, insurance and regulatory liabilities.

- Non-compliance and government deregistration fines.

- Service provider, contractor and supplier invoices.

Timeline and fees for Company liquidation in Dubai

Company liquidation Dubai consists of punctuality in terms of fees and timeline in order to avoid delay and rejections of the processing. Here is a quick tabular breakdown for you —

| Stage | Est time | Typical fees (AED) |

| Board resolution & appointment | 1 to 3 days. | 500 to 2,000 |

| Initial liquidation approval | 2 to 5 days | 500 to 2,000 |

| Newspaper notice period | 45 days | 1,500 to 3,000 |

| Visa & labour cancellations | 5 to 10 days | 500 to 800 per visa |

| NOC clearance | 7 to 20 days | Variable |

| Final audit & report | 7 to 21 days | 2,500 to 10,000 |

| License cancellation | 1 to 3 days | 1,000 to 3,000 |

| Total time (Mainland) | 60 to 90 days | 8,000 to 25,000 |

| Total time (Free Zone) | 30 to 60 days | 6,000 to 15,000 |

| Offshore | 15 to 45 days | 4,000 to 10,000 |

Why use PRO for closure of Company liquidation in Dubai?

Applying through one professional Pro to achieve company liquidation Dubai can support with time efficiency regulatory compliance and smooth processing. PRO can accurately support multiple authority coordination, documentation, visa cancellation, closure of lease, overseas bank and secure mandatory NOCs.

PRO experience and expertise can easily mitigate errors, track deadlines, avoid penalties and assure correct company liquidation while providing clear VAT deregistration guidance maintaining total closure cost breakdown with transparency.

How about learning the best PRO services?

Conclusion

Company liquidation Dubai is a well-structured legal procedure that demands authority clearance, debt settlement, document readiness and precision. Professional support and proper planning can eventually help in avoiding extended timelines and costly fines. Now, whether you are looking to close mainland or free zone entities, with the right steps for smooth exit, a proper PRO liquidator can help you with transparency.

Let’s Connect with Us and collect your legal support for Dubai company liquidation.

Frequently Asked Questions (FAQs)

Is it necessary to get Dubai company liquidation with support of a licensed liquidator?

Licensed liquidators are necessary in mainland LLCs but some of the free zones do not require Dubai company liquidation.

Can I liquidate my company without any Visa clearance?

No, all the partner and employee visas need to be cancelled first.

How long will it take to get the newspaper notice period for liquidation?

It will take around 45 days for Mainland companies for newspaper notice period liquidation.

Does Dubai company liquidation comprise VAT deregistration?

Yes, VAT deregistration with FTA is an important one if registered.

What is the consequence of delaying company liquidation Dubai?

Accumulation of unpaid fines can lead to immigration and legal issues.

No comment yet, add your voice below!