Setting up a company in the UAE, whether in the Mainland, a Free Zone, or as an offshore entity, requires strict adherence to legal and regulatory obligations. Central to this compliance framework is the identification and disclosure of the Ultimate Beneficial Owner (UBO) UAE.

This blog post answers essential questions about UBO requirements, why they are mandatory for your trade license, and the legal implications of non-compliance.

What is the Ultimate Beneficial Owner (UBO) UAE?

The Ultimate Beneficial Owner (UBO) is the natural person who ultimately owns or controls a company, even if that ownership or control is exercised indirectly through other entities or nominees.

- Definition: The UBO is the natural person who ultimately owns or controls a company.

- Key Distinction: A UBO must be a natural person; therefore, a company cannot be its own UBO.

- Purpose of UBO Law: UBO transparency is a requirement under Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. This requirement aims to enhance corporate transparency, facilitate regulatory reporting, and build trust with investors and clients.

How to Identify and Determine the Ultimate Beneficial Owner UAE

Identifying the UBO is the responsibility of the company itself, though shareholders must provide supporting documents. Identification follows specific criteria laid out in the regulations:

1. Ownership and Control Criteria for Ultimate Beneficial Owner UAE

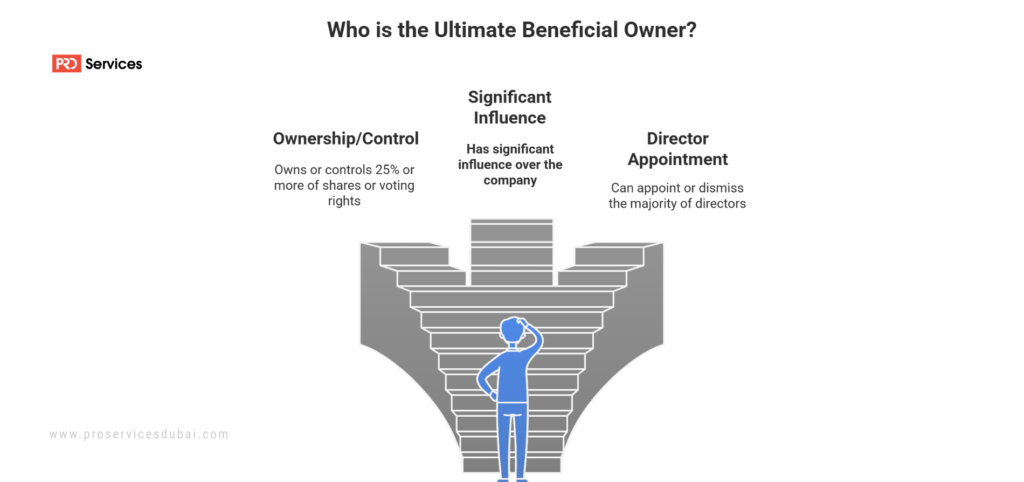

An individual is generally considered the UBO if they meet one of the following criteria:

- The natural person owns or controls 25% or more of the shares or 25% or more of the voting rights in the Legal Person.

- The person has significant influence over the company.

- Control may also include the right to appoint or dismiss the majority of the Directors.

2. Identifying UBOs Through Complex Structures (Example)

In cases of indirect ownership, the ultimate controller must be tracked:

- Example: If Company A is owned by Company B, and an individual controls Company B, that individual is the UBO of Company A.

3. The Fallback Rule

If, after applying all reasonable means, no natural person can be identified based on the ownership and control criteria, the natural person who holds a position in Higher Management shall be deemed the Beneficial Owner (BO).

UBO and Trade Licenses: Mandatory Compliance and Legal Implications

Is the UBO Declaration Mandatory?

Yes, UBO disclosure is mandatory. UBO reporting is required for trade license issuance and renewal in both Free Zones and the Mainland. This mandate extends to offshore companies as well.

Accurate disclosure is necessary for smooth banking operations, as banks require UBO information for corporate account opening and to prevent AML and fraud risks.

What are the Legal Obligations and UBO Registers?

To maintain compliance with the UBO law, companies (Legal Persons) have specific obligations regarding data submission and maintenance:

1. Mandatory Registers

The company must establish and maintain two registers:

- Register of Beneficial Owner (BO Register): This must be established within 60 days of incorporation or licensing. It must detail the UBO’s full name, nationality, date/place of birth, address, passport/ID number, and the basis/date they obtained BO status.

- Register of Partners or Shareholders: This register must detail shares, voting rights, and personal data (including passport/ID copy) for all natural persons listed, including any Nominee Board Members or Trustors.

2. Updating Timelines

Any changes to the data in either the BO Register or the Register of Partners or Shareholders must be recorded and updated within 15 days of the company becoming aware of the change.

3. Basic Trade License Data

During the initial application or renewal, the Legal Person must provide basic licensing data, including the company name, legal form, memorandum of association, and the principal office address.

What is the Penalty for UBO Non-Compliance?

Non-compliance with UBO requirements can lead to serious legal and operational consequences:

- Administrative Sanctions: The Minister or any delegated Licensing Authority may impose administrative sanctions for contravention of the decision’s provisions.

- Fines and Suspension: Non-compliance may result in fines, license suspension, or legal penalties.

- Operational Delays: Failure to provide accurate UBO disclosure can lead to banking delays and increased regulatory scrutiny during audits or inspections.

The Role of PRO Services in UBO Compliance

The regulatory burden associated with UBO disclosure makes professional PRO services essential for seamless operation. A PRO helps manage the specific liaison points required by law:

- Designated Liaison: The company must designate a natural person residing in the UAE who is authorized to provide UBO and shareholder data to the Registrar. A PRO often manages this liaison and ensures all data is submitted accurately.

- Initial Submission: Registers must be furnished to the Registrar within 60 days of licensing or registration.

- Record Retention: The company must maintain all records and data for at least five years after dissolution, liquidation, or de-registration.

- Liquidation: If the company is liquidated, the liquidator must submit the BO and shareholder registers to the Registrar within 30 days of appointment.

A Note on Nominee Board Members

Managers or board members acting as a Nominee Board Member (acting under the instructions of another person) must inform the Legal Person of their capacity and provide all required data within 15 days of taking or ceasing the position.

Tip for Compliance: Keep UBO records updated, especially during ownership changes, to ensure timely compliance with UAE laws and avoid compliance pain points.

(Note: The sources provided facilitate audits, inspections, and regulatory reporting, but they do not contain information regarding whether an audit is mandatory for all companies in the UAE.)

Frequently Asked Questions

What is a UBO in the UAE?

The Ultimate Beneficial Owner (UBO) is the natural person who ultimately owns or controls a company, either directly or indirectly through other entities. Companies themselves cannot be UBOs; it must be a natural person.

Why is UBO disclosure important for UAE trade licenses?

UBO disclosure is mandatory for trade license issuance and renewal. It ensures compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations and facilitates smooth banking operations.

How do I identify the UBO of my company?

A UBO is generally identified if they own or control 25% or more of the shares or voting rights, have significant influence over the company, or can appoint/dismiss the majority of directors. In complex ownership structures, the ultimate controller of parent companies must be traced. If no natural person is identifiable, a senior management member may be deemed the BO. More detailed answer for this question you can find from Central bank of UAE website

No comment yet, add your voice below!